Michigan Inheritance Tax 2025. Guide to iowa inheritance tax. Rendered thursday, march 7, 2025 page 1 michigan compiled laws complete through pa 11 of 2025.

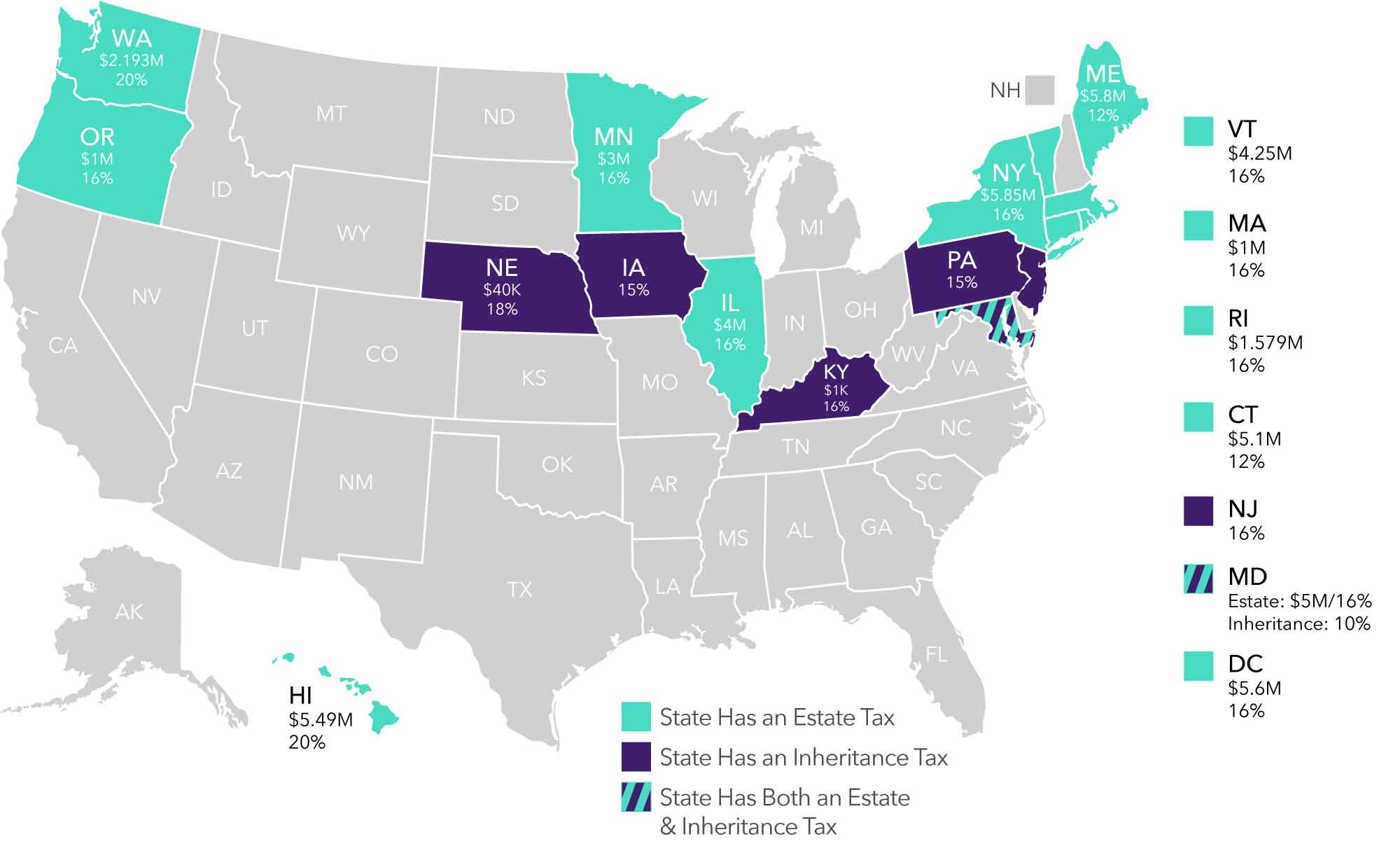

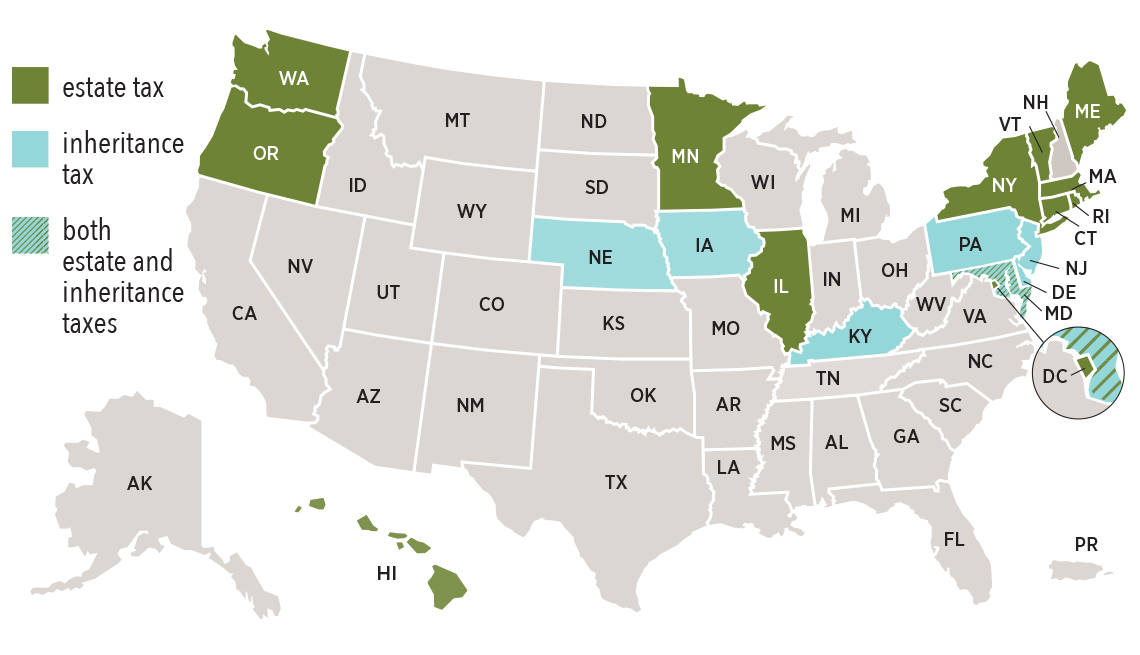

Estate and Inheritance Taxes Urban Institute, Since michigan is not a state that imposes an inheritance tax, the inheritance tax in 2025 is 0% (zero). Only a handful of states still impose inheritance taxes.

Which States Have Inheritance Tax? Mercer Advisors, However, the rate will go back up to. An inheritance tax return must be filed for the estates of any person who died before october 1, 1993.

Michigan form 163 Fill out & sign online DocHub, Last year's legislation reduced the michigan personal income tax rate from 4.25% to 4.05%, but only for one year, the panel of judges declared. Michigan has two types of inheritance taxes:

Inheritance Tax How Much Will Your Children Get? Your Estate Tax, A copy of all inheritance tax orders on file with the probate court. You will pay $0.00 in taxes on the first $11,700,000.00.

inheritance tax rate in michigan Annmarie Rollins, When making plans for your. However, the rate will go back up to.

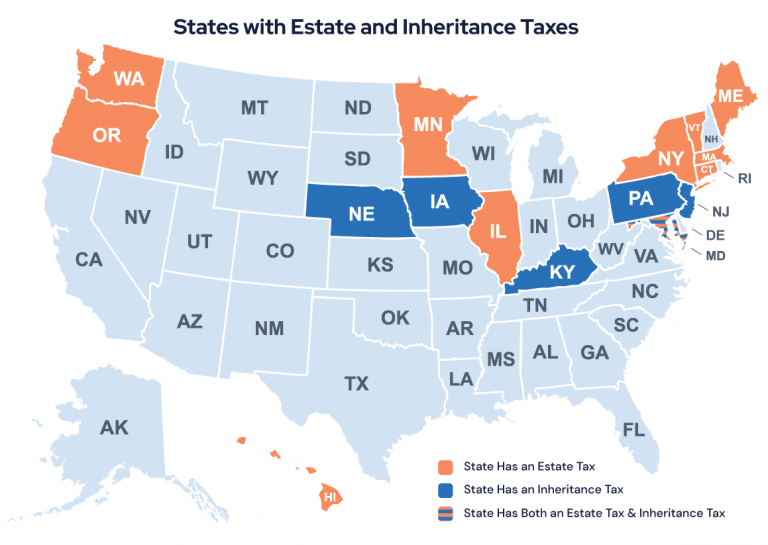

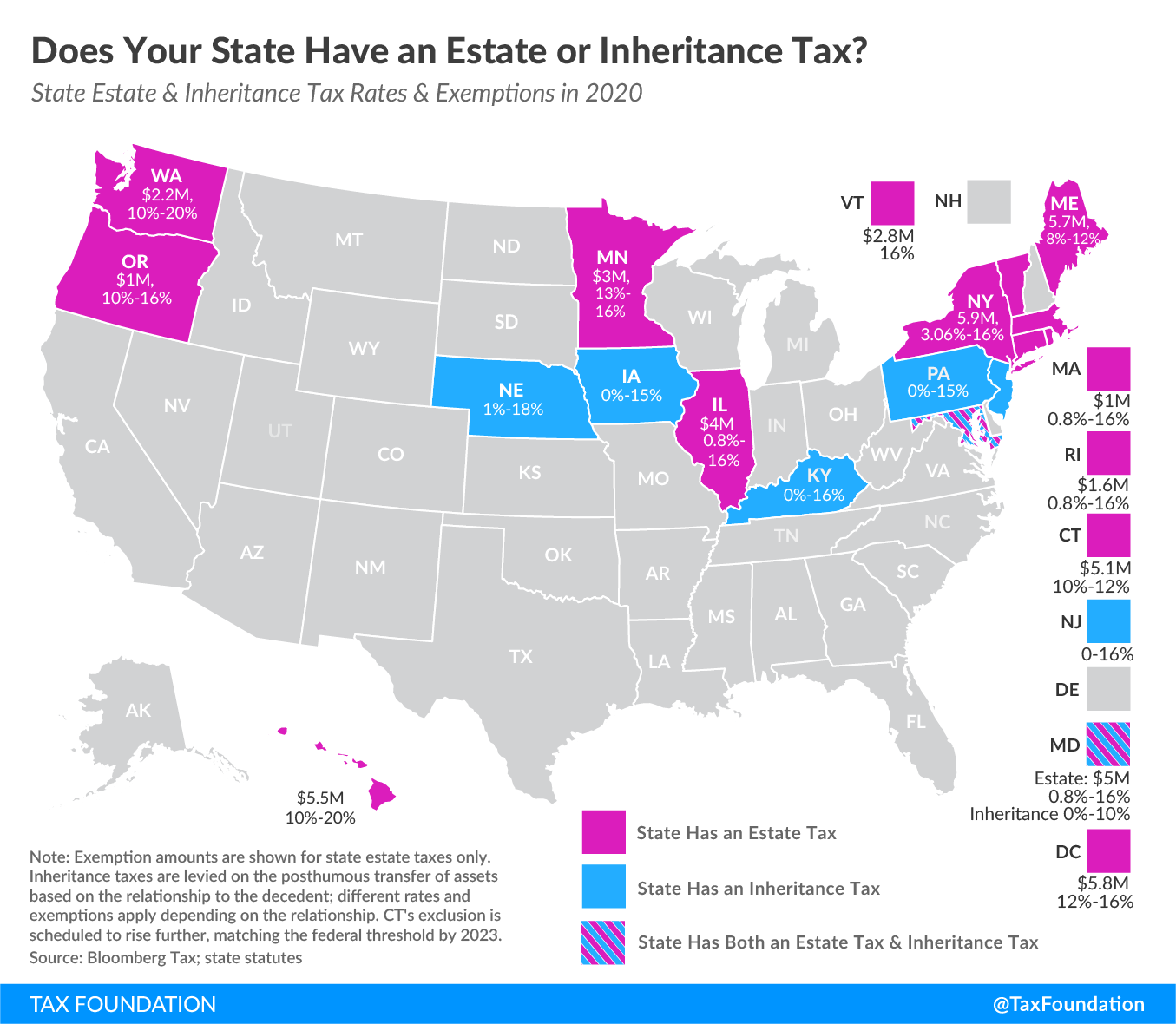

17 States With Estate Taxes or Inheritance Taxes, President biden and congress enacted a 1 percent excise tax on stock buybacks last. New york has one of the highest state income tax rates in the u.s.

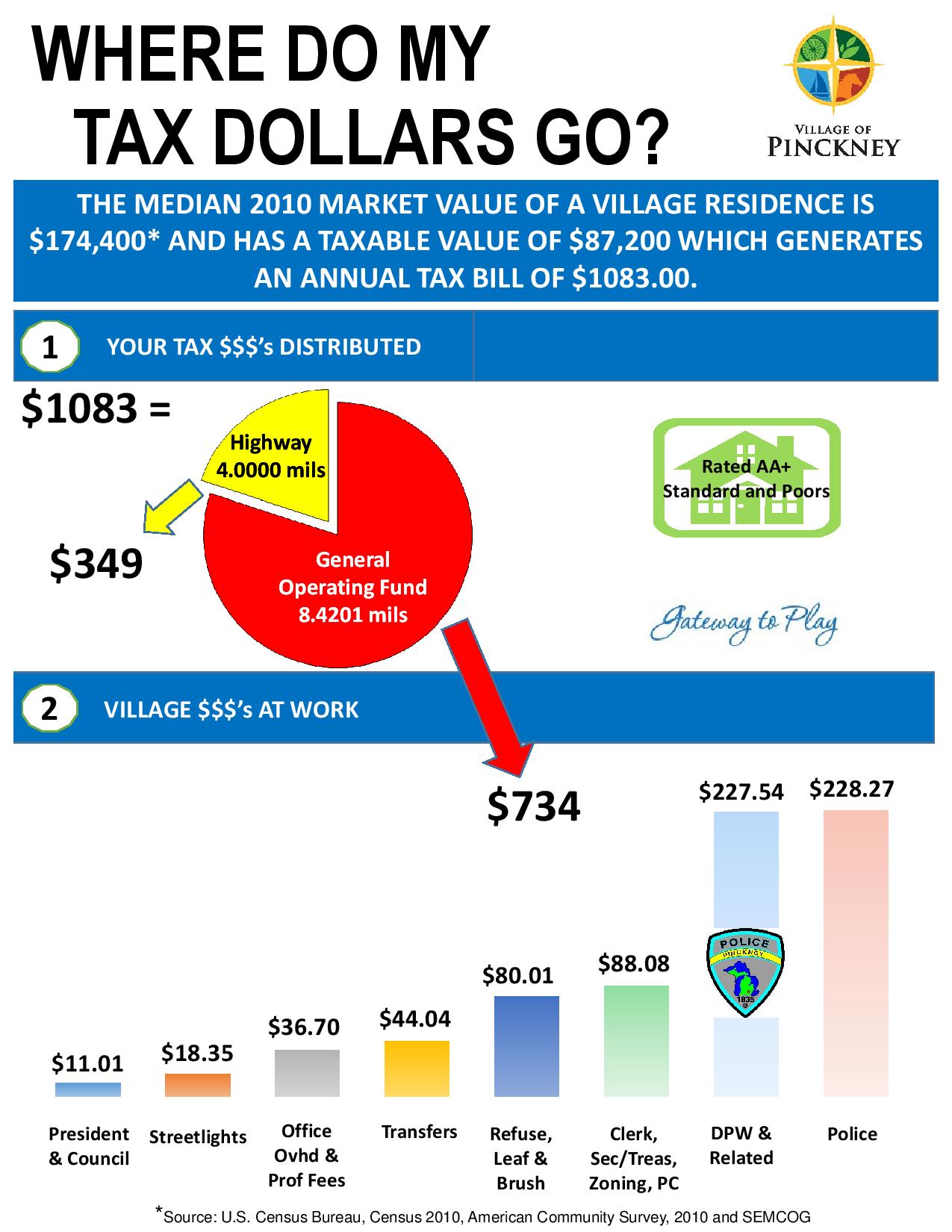

A Guide to the Best and Worst States to Retire In, For instance, if you inherit a property initially. A personal representative’s fee (or executor’s fee) which is paid by the person responsible for administering the.

17 States that Charge Estate or Inheritance Taxes Alhambra Investments, Piecemeal approach to tax reforms brings danger. 28 announced the 4.25 percent income tax rate for individuals and fiduciaries for the 2025.

Does Your State Have an Estate Tax or Inheritance Tax? Tax Foundation, A copy of all inheritance tax orders on file with the probate court. 28 announced the 4.25 percent income tax rate for individuals and fiduciaries for the 2025.

Estate Tax and Inheritance Tax Considerations in Michigan Estate Planning, Even though there is no michigan estate tax, you might still owe the federal estate tax. Some states are looking to abolish property taxes entirely.

Last year’s legislation reduced the michigan personal income tax rate from 4.25% to 4.05%, but only for one year, the panel of judges declared.